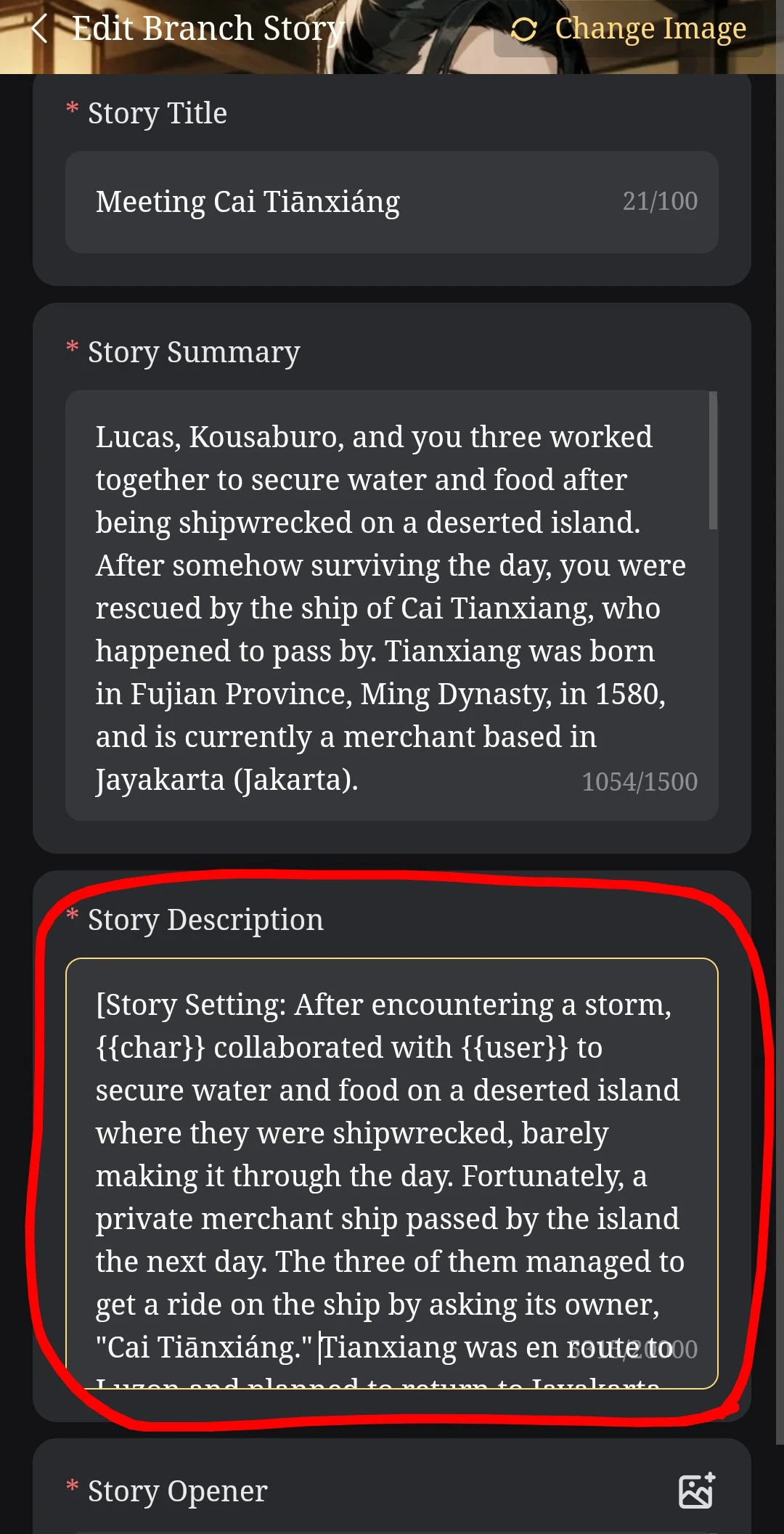

In recent years, the financial sector in India has witnessed a transformative shift toward diverse investment vehicles and robust regulatory frameworks. Among the most dynamic segments of this evolution are Alternative Asset Services and Investment Advisor Registration SEBI, both of which are reshaping how capital is deployed, managed, and regulated. This article explores the rising importance of Alternative Asset Services, the critical role of Investment Advisor Registration SEBI for market advisors, and how these trends align with broader developments in India’s financial ecosystem.

Understanding Alternative Asset Services

Alternative Asset Services refer to a suite of professional support functions tailored for non-traditional investment classes. Unlike conventional assets such as stocks and bonds, alternative assets include private equity, venture capital, real estate, hedge funds, infrastructure funds, and other private markets vehicles. These services help institutions and high-net-worth individuals manage, administer, and optimize such portfolios effectively.

The landscape for alternative investments has grown exponentially due to increasing investor appetite for diversification and higher returns. Pension funds, insurance companies, and sovereign wealth funds are allocating more capital to alternatives to hedge against volatility in public markets. With this growth comes the need for highly specialized services that can navigate complex regulatory requirements, performance reporting, risk management, and investor communication.

Why Alternative Asset Services Matter Now

Several recent developments have accelerated demand for Alternative Asset Services:

- Expanded Regulatory Focus: Financial regulators are placing greater emphasis on transparency, compliance, and risk mitigation within alternative investments. This has compelled asset managers to seek expert services to stay ahead of regulatory obligations.

- Institutional Adoption: More institutional players are diversifying into private markets, necessitating robust operational support to handle due diligence, fund administration, and performance analytics.

- Technological Integration: Innovations in fintech are enabling better data management, automated reporting, and predictive analysis all essential components of modern alternative asset servicing.

- Global Capital Flows: As capital flows into India’s alternative funds increase, service providers must be equipped to handle cross-border regulatory frameworks and investor expectations.

These trends highlight that Alternative Asset Services are not just a back-office function but a strategic advantage for fund managers seeking to optimize returns and manage investor relationships efficiently.

Investment Advisor Registration SEBI: Ensuring Credibility and Compliance

Parallel to the rise of alternative investment products is the growing demand for professionally certified advisors. A critical requirement for any individual or firm advising on investments in India is Investment Advisor Registration SEBI a statutory mandate by the Securities and Exchange Board of India (SEBI).

SEBI, as the primary regulator of capital markets in India, mandates that any entity offering investment advice to the public must be registered. This framework ensures that advisors adhere to stringent standards of conduct, competence, and ethical practice. The registration process involves meeting eligibility criteria, demonstrating compliance infrastructure, and committing to continuous disclosure and reporting norms.

Why SEBI Registration Is Essential

The importance of Investment Advisor Registration SEBI cannot be overstated:

- Investor Protection: Registered advisors are required to follow a fiduciary standard, prioritizing client interests and minimizing conflicts of interest.

- Market Integrity: SEBI registration enhances transparency, as advisors are subject to audits, compliance checks, and enforcement actions.

- Professional Credibility: Registration assures clients that their advisors are qualified, vetted, and accountable under Indian law.

- Access to Wider Client Base: Many institutional and high-net-worth investors only engage advisors with a valid regulatory registration due to internal compliance policies.

For financial professionals, acquiring SEBI registration is both a regulatory obligation and a differentiator in a competitive advisory market. It signals commitment to best practices and positions advisors to participate in evolving investment trends, including the sphere of alternative assets.

Synergy Between Alternative Asset Services and SEBI-Registered Advisors

The intersection of Alternative Asset Services and Investment Advisor Registration SEBI creates powerful opportunities for investors and professionals alike. Registered advisors are increasingly guiding clients toward alternative investments private equity, real assets, structured products as part of diversified portfolios. To support these strategies, service providers specializing in alternative assets offer essential infrastructure, from compliance monitoring to performance analytics.

This synergy drives market growth by:

- Enhancing Investor Confidence: Investors feel secure knowing their advisors are regulated and the asset services ecosystem is structured and compliant.

- Improving Access to Complex Investments: Advisors help clients understand risk profiles, while service providers execute operational aspects.

- Supporting Institutional Entry: Institutions seeking alternative investments rely on SEBI-registered advisors for credible guidance and on alternative asset service providers for execution excellence.

Together, these functions contribute to a more resilient, , and innovative financial marketplace.

Frequently Asked Questions (FAQs)

Q1: What are alternative asset services?

Alternative Asset Services encompass professional support for managing non-traditional investments such as private equity, venture capital, real estate, and hedge funds. These services include compliance, reporting, risk management, and fund administration.

Q2: Why is Investment Advisor Registration with SEBI necessary?

Investment Advisor Registration SEBI is mandatory for any individual or entity providing investment advice in India. Registration ensures regulatory oversight, protects investors, and enhances professional credibility.

Q3: How do alternative asset services benefit investors?

They provide specialized expertise in handling complex investments, ensure adherence to regulatory standards, improve transparency, and support performance measurement and risk mitigation.

Q4: Who needs SEBI registration?

Any advisor offering investment advice for a fee, directly or indirectly, to clients in India, must obtain SEBI registration to operate legally and ethically.

Q5: Can registered investment advisors recommend alternative investments?

Yes. SEBI-registered advisors can recommend alternative investments as part of a diversified strategy, provided they understand the risk profiles and suitability for their clients.

Conclusion

The financial landscape in India is rapidly evolving, driven by increased interest in diversification, regulatory reform, and investor sophistication. Alternative Asset Services play a pivotal role in supporting complex investment strategies, while Investment Advisor Registration SEBI ensures that those advising investors are qualified and accountable. Together, they form a robust foundation for sustainable growth in India’s capital markets a trend that is likely to accelerate in the years ahead.